Accessing Payroll Information

Publicis Payroll

Accessing Payroll Information

How do I access my Payroll Information?

At Publicis Groupe, you can access all your payroll information via the MyADP portal.

Direct deposit information: You can add, delete or change your direct deposit accounts on MyADP. No forms are necessary.

Tax withholding information: You can update your federal and state tax elections (W-4) online. *Note that there may be instances that require paper forms to be completed and sent to HR.

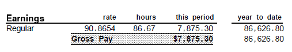

Pay statements: You can view, download and/or print your earnings statements.

Annual W-2 Form: You have access to view, download and/or print your annual W-2 Forms at any time. *Note: Forms for the previous year will be added to your account by January 31 each year.

How do I log in to MyADP?

To access your payroll information, go to the MyADP portal. Your user ID will include @publicis, e.g., jsmith@publicis. The preferred browser is Google Chrome, or you can download the ADPMobile app.

If you are a new user, you’ll need to set up a User ID by navigating to MyADP; click the Get Started link and follow the prompts.

You should have received an automated email from ADP Security Services with a personal registration code that is active for 14 days. You can click I have a registration code and use your personal registration code.

If you do not create your User ID using this personal registration code within the first 14 days, you can use a generic registration code: publicis-entry.

You will then proceed to enter in your personal information.

If you forgot your user ID, click the Forgot your User ID link on the MyADP log in page and follow the prompts.

If you forgot your password, enter your User ID (ending in @publicis) and click the Forgot your password link and follow the prompts.

How do I modify my direct deposit?

You have access to your direct deposit banking elections through MyADP Portal/MobileApp.

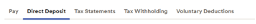

Step one: Select the Pay icon on the MyADP landing page.

Step two: Select the Direct Deposit tab. From there you can add, remove, edit elections.

Understanding Pay and Deductions

What is gross and net pay?

Gross pay is the total amount an employee earns before any deductions, including taxes, health insurance, retirement contributions, and other withholdings.

Net pay, often referred to as "take-home pay," is the amount an employee receives after all deductions are applied. This is the actual amount on their Check or deposited into their bank account(s) on payday.

What are Deductions-Statutory on my pay stub?

"Deductions-Statutory" on your pay stub refer to mandatory tax withholdings that your employer deducts from your gross earnings and submits to the appropriate government agencies. These include:

Federal, State, and Local Taxes – Income tax withholdings based on your filing status and tax bracket.

FICA Taxes – Social Security and Medicare taxes required under the Federal Insurance Contributions Act (FICA).

Unemployment & Disability Insurance – Contributions to state and federal unemployment & Disability programs.

State Medical Family Leave – Contributions to state Medical Family Leave programs.

Worker’s Compensation – A required deduction in some states to fund benefits for employees injured on the job.

Wage Garnishments – Court-ordered deductions for debts such as child support or unpaid loans.

These differ from Deductions/Other, which cover voluntary benefits like health insurance, retirement savings, or flexible spending accounts.

What are Social Security and Medicare taxes?

Social Security and Medicare taxes are part of the Federal Insurance Contributions Act (FICA), which funds benefits for retirees, individuals with disabilities, and healthcare programs.

Employers and employees each contribute:

6.2% for Social Security (up to the annual wage limit set by the Social Security Administration).

1.45% for Medicare, with an additional 0.9% Medicare surtax on earnings exceeding the IRS threshold.

Wage Garnishments

What are Wage Garnishments?

Wage garnishments are court-ordered deductions taken from an employee’s paycheck to satisfy a debt or legal obligation. These deductions are typically a percentage of the employee’s earnings rather than a fixed dollar amount.

What debts can lead to Wage Garnishments?

Common reasons for wage garnishments include:

Child support

Unpaid taxes

Credit card debt

Defaulted student loans

Medical bills

Outstanding court fees

How are Wage Garnishments calculated?

The amount deducted is determined by federal and state laws, which set limits on how much can be garnished from an employee’s wages to ensure they retain sufficient income for basic living expenses

Additional information can be found on MyADP Portal – Pay – Wage Garnishment. If you have a question about wage garnishments, please contact the ADP Solution Center at 1-866-324-5191.

Pay Frequency

When and how frequently do I get paid?

Semi-monthly employees are paid on the 15th (or preceding business day if 15th falls on a Federal Holiday or weekend) and the last business day of the month.

Bi-Weekly employees are paid every two weeks on Friday (or preceding business day if Friday is a Federal Holiday) following the pay period end date.

When will I receive my pay if payday is a holiday?

If pay date falls on a weekend or Federal Holiday, employees will be paid on the preceding business day.

W-2 Forms

When and who should receive a W-2 Form?

Employees in the United States who earn wages should receive a W-2 form. Employers are responsible for preparing and issuing this form. W-2 forms must be delivered to employees by January 31st each year. This deadline helps individuals prepare their tax returns on time.

To access your W-2 forms (Tax Statements) or opt-in for eDelivery (Settings/Go Paperless) sign-in to MyADP.

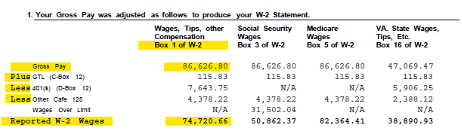

Why does my W-2 form Box 1 declare a different amount than my final pay stub total gross earnings?

W-2 forms and final pay stubs declare different annual income amounts in an employee’s total earnings because the pay stub includes the gross pay, tax taken, deductions and net pay. W-2 Box1 shows the Federal taxable wage.

See the example below:

Common W-2 Questions

I terminated employment on or before the 15th of the month. Why were my benefit deductions doubled?

Pretax deductions are doubled to cover the cost of your benefits coverage through the last day of the month.

Why is Social Security tax being withheld from my pay again when I already reached the maximum withholdings with my prior employer?

As the IRS guidelines indicate, once you hit the Social Security wage base limit for the year with one employer, they stop withholding SS taxes. However, when you switch employers, the new employer starts with a fresh year-to-date total. This is because each employer has its own federal ID number, and they don’t have access to your earnings history from a prior employer. Therefore, your new employer will begin withholding Social Security taxes as if you haven't reached the limit yet.

You can file a claim for the overpayment of Social Security tax with the IRS or wait until you file your tax return. If too much was withheld, you'll get a refund of the excess amount after your taxes are filed.

What Is a W-2 Form and why do I need it?

A W-2 form, also referred to as the Wage and Tax Statement, is essential for reporting taxes. It reflects your earnings and taxes withheld by your employer for the calendar year.

Employers must issue W-2 forms to employees by January 31 each year. This ensures you have enough time to prepare for tax filing.

The form contains essential details that help complete your tax return. Information includes wages, Social Security tax withheld, Medicare taxes withheld, Federal and State taxes withheld and other tax related information.

To access your W-2 forms (Tax Statements) or opt-in for eDelivery (Settings/Go Paperless) sign-in to MyADP.

When and who should receive a W-2 Form?

Employees in the United States who earn wages should receive a W-2 form. Employers are responsible for preparing and issuing this form. W-2 forms must be delivered to employees by January 31st each year. This deadline helps individuals prepare their tax returns on time.

To access your W-2 forms (Tax Statements) or opt-in for eDelivery (Settings/Go Paperless) sign-in to MyADP.

What information is included on a W-2 Form?

The W-2 form has important information about your income and the taxes that have been taken out. It’s important to understand each section of the form.

Various boxes on the W-2 provide additional details:

Box 1: Federal Income Taxable Wages, tips, and other compensation

Box 2: Federal income tax withheld

Box 3: Social Security wages

Box 4: Social Security tax withheld

Box 5: Medicare wages and tips

Box 6: Medicare tax withheld

Box 15: State code

Box 16: State Income Taxable Wage

Box 17: State Income Tax withheld

Understanding these entries helps ensure you report your income accurately. It also assists with reconciling your own records when preparing your tax return.

To access your W-2 forms (Tax Statements) or opt-in for eDelivery (Settings/Go Paperless) sign-in to MyADP.

How many W-2s will I receive if I was taxed in more than one state?

Employees will receive one W-2 per employer/legal entity (ADP Paygroup listed in the upper left corner of the form). Your HR representative can help if you have question(s) pertaining to the paygroups listed on the W2 form(s). If you were taxed in multiple states, your W-2 will include separate pages for each state jurisdiction, showing the taxable wages and withholding for that state.

How can I request a duplicate W-2 Form?

MyADP offers employees electronic access to Pay Statements and US W-2s issued in the last three years. Utilizing electronic access not only simplifies filing but also enhances efficiency and security.

To access your W-2 forms (Tax Statements) or opt-in for eDelivery (Settings/Go Paperless) sign-in to MyADP.

If you need pay documents older than three years, please reach out to your HR representative.

What should I do if there are errors on My W-2 Form?

Finding errors on your W-2 can be stressful. It is important to fix any errors to make sure your taxes are correct. Start by reviewing the form carefully to identify the specific mistakes. Once you’ve spotted the errors, contact your HR Representative. Explain the inaccuracies in detail. HR will contact Payroll Services if adjustments are needed.

Be aware of common errors that can appear on W-2 forms, such as:

Incorrect Social Security Number (SSN)

Incorrect wages or tax withheld

Incorrect employer details

Can I access my W-2 Form electronically?

To access your W-2 forms (Tax Statements) or opt-in for eDelivery (Settings/Go Paperless) sign-in to MyADP.

Multi State Tax Information

Publicis Groupe operates in multiple states across the U.S. Most state tax authorities require employers to report and withhold on wages earned by employees for services performed within their state’s borders. These laws generally apply to all employees, both those who reside within the state’s borders and those who travel into the state to work, and often includes travel on a temporary basis.

For additional information or questions visit Article | Marcel