How to choose your benefits

At Iron Mountain, we want you to understand your benefit options so you can make the best choice for you and your family. This page outlines your medical plan options, offers tips for choosing your benefits, and points you to resources for personalized advice.

-

Which medical plan is best for you in 2026?

The medical plan options available to you depend on your location. Most Mountaineers have a choice of four national plans managed by Aetna. If you live in California, Kaiser is also available. If you live in Hawaii, you are eligible for Kaiser HI. If you live in Puerto Rico, you are eligible for Triple-S.

Review the chart below to understand each plan and see what meets your needs.

Plans Select Network Plan

(multi-tier EPO)Choice PPO Plan

(multi-tier POS)Enhanced HDHP

(multi-tier HSA plan)Basic HDHP

(HSA plan)Kaiser

(HMO plan)

(California and Hawaii)Overview Highest premium with lowest deductible and coinsurance Second highest premium with mid-level deductible and coinsurance Second lowest premium with mid-level coinsurance and a higher deductible Lowest premium with highest deductible and coinsurance Highest premium, no deductible, low copays Two-tier network ✔ ✔ ✔ One network only One network only Free preventive care with in-network providers ✔ ✔ ✔ ✔ ✔ Free preventive care prescriptions

(i.e for heart disease, stroke, diabetes)✔ ✔ ✔ ✔ ✔

Understanding two-tier networks

The Aetna Select Network Plan, Choice PPO Plan, and Enhanced HDHP each use a two-tier network to help you save money. Your out-of-pocket healthcare costs are determined by your provider’s network tier.

Tier 1: Maximum Savings – a narrower network that provides lowest costs*

Tier 2: Standard Savings – a broader network that provides standard cost savings

For help understanding your network provider options, contact your Aetna One Advisor (A1A) is your personal benefits advisor. A1A can support all Mountaineers in understanding their benefits. Call 888-216-8573, Monday-Friday, from 8:00 AM to 8:00 PM ET.

*All in-network mental health visits are considered Tier 1 and provide the maximum savings.

-

What to consider when choosing a medical plan

Selecting the right medical plan involves weighing the factors that affect you and your family. The information below highlights some key considerations when choosing a medical plan.

Healthcare needs

Evaluate your current situation and expected medical needs in 2026.

Do you have upcoming procedure or ongoing treatments?

Has your (or your family’s) health changed?

Your share of costs

Premium – What you pay out of each payroll for your elected plan

Deductible – What you pay before the plan pays (in-network preventative care is always 100% covered) (Aetna only)

Copay – Flat fee per doctor visit (after deductible, if applicable)

Coinsurance – Percentage of the bill you share (after deductible and copays, if applicable)

Your out-of-pocket maximum

This is the most you’ll pay in a year, including deductibles, coinsurance, and copays for in-network care.

-

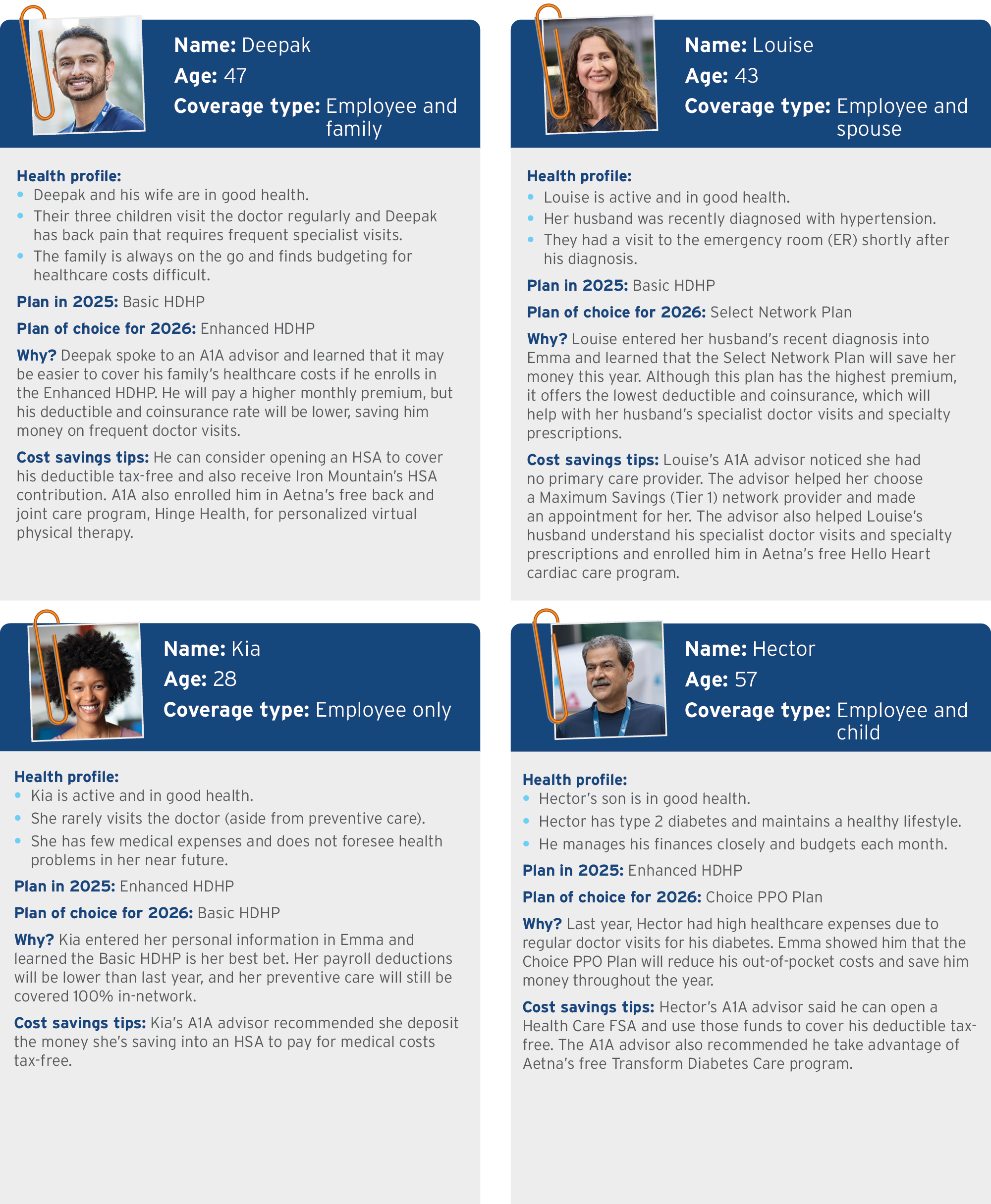

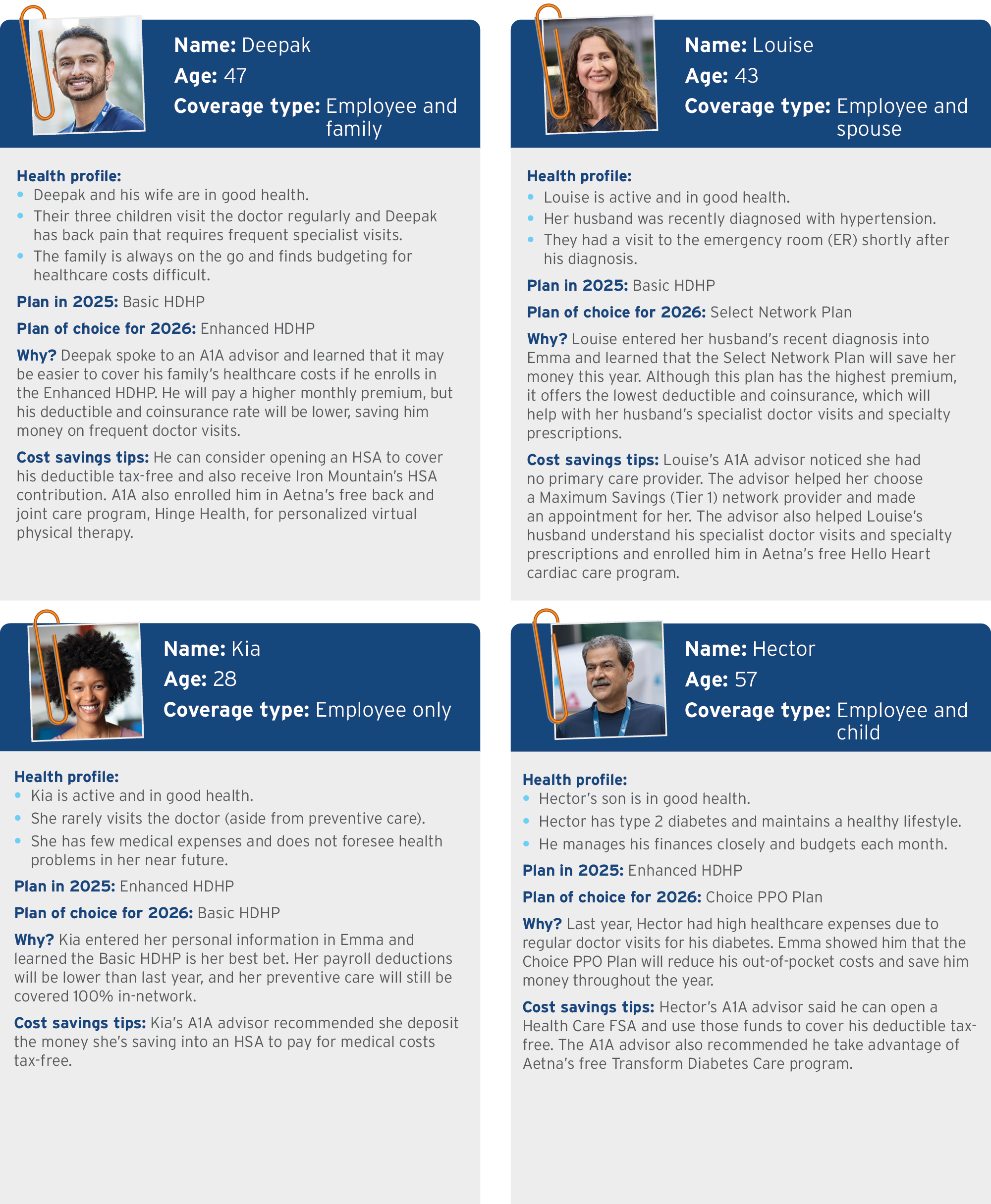

See what plans Mountaineers like you are choosing

These examples show how different considerations come together in making a health plan choice. Explore the profiles below to see how each person looked at their situation to find the best plan.

-

Four cost-saving tips

Choose a Maximum Savings (Tier 1) Primary Care Provider (PCP)

Free preventative care: In-network annual checkups and screenings are covered at no cost to you.

Better long-term health: Regular preventative care helps avoid costly illness later.

Know where to go for care

Maximum Savings (Tier 1) providers will save you the most, and typically cost less than urgent care or ER visits. In-network mental healthcare (in-person or virtual) is always Maximum Savings (Tier 1).

The MinuteClinic® at CVS offers free or low-cost visits, including mental healthcare for those 13 years or older.

CVS Virtual Care® has shorter wait times and affordable pricing.

Learn more about CVS Virtual Care here.

Quit tobacco use

Avoid the tobacco surcharge while improving your health.

Free nicotine replacement therapy and coaching are available through Aetna’s Tobacco Cessation Program for all benefits-eligible Mountaineers. Call A1A at 888-216-8573 to get started.

Consider an HSA or FSA - You must enroll in these plans each year you wish to contribute. Participation does not roll over from year to year.

Health Savings Account (HSA)

An HSA allows you to save pre-tax dollars for medical expenses, reduce taxable income, and invest for future expenses.

To enroll in an HSA, you must be enrolled in the Aetna Enhanced or Basic HDHP plan.

With the Enhanced HDHP, Iron Mountain contributes to your HSA.

2026 contribution limits are increasing to $4,400 for individuals and $8,750 for families. Participants 55 and older can contribute an additional $1,000 catch-up contribution.

Once enrolled in an HSA, you will receive an email from Fidelity advising you to access NetBenefits to activate your HSA. The Activate HSA link is found under the “Your account and benefits” section on the NetBenefits homepage. This step is necessary to have full access to the account (i.e., ability to use your debit card, invest funds, and set up beneficiaries).

HSA funds stay with you from year to year and remain yours, even if you leave Iron Mountain.

Flexible Spending Accounts (FSAs)

You can use these accounts to pay for eligible expenses with pre-tax dollars.

2026 contribution limit for Dependent Care FSA is increasing to $7,500 per household. There are eligibility limits for highly compensated Mountaineers.

The funds must be spent by March 15 of the following year, or you lose them.

Type of FSA Used for Available to Health Care FSA Out-of-pocket medical, dental, vision, and prescriptions Mountaineers enrolled in Aetna Select, Choice or Kaiser plans Limited Purpose FSA Dental, vision, prescriptions, and medical expenses after you reach your deductible Mountaineers in the Aetna Enhanced or Basic HDHP plans Dependent Care FSA Eligible child or elder care expenses All benefit eligible Mountaineers (no medical plan required); eligibility limits apply to highly compensated Mountaineers

-

Get personalized decision support

Aetna One Advisor (A1A), your personal benefits advisor

Did you know that Aetna One Advisor (A1A) is your personal benefits advisor? They can help you compare medical plan options, choose the best fit for you and your family, find quality cost-effective providers, and offer tips to get the most from your plan. Once you call, your advisor provides personalized support all year long.

Your A1A advisor can help you:

Tap into free preventative services and condition management programs

Find top-quality and budget-friendly providers, schedule appointments, and coordinate your care (including pre-certifications)

Make informed decisions about treatment options

Understand your prescription drug coverage

Sort out an plan or claim issues

A1A can support all Mountaineers in understanding their benefits.

Call 888-216-8573, Monday-Friday, from 8:00 AM to 8:00 PM ET. Aetna members can also chat online through the Aetna member website (aetna.com).

Learn more about Aetna One Advisor (A1A).

Emma™: A personal decision support tool

Emma is an online tool designed to help you choose which plan is best for you during Open Enrollment or when making life event changes. Emma looks at 12 months of your and your enrolled dependents’ medical claims history (if available) to compare coverage options for the coming year. Just answer a few questions and Emma will give a personalized comparison of your medical plan costs, including payroll deductions and expected out-of-pocket costs when you use the plan. Log in to the Iron Mountain Benefits Center via the bswift mobile app or on the web here to get started.